Financials

Unaudited Condensed Financial Statements For the second half year and full year ended 31 December 2024

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

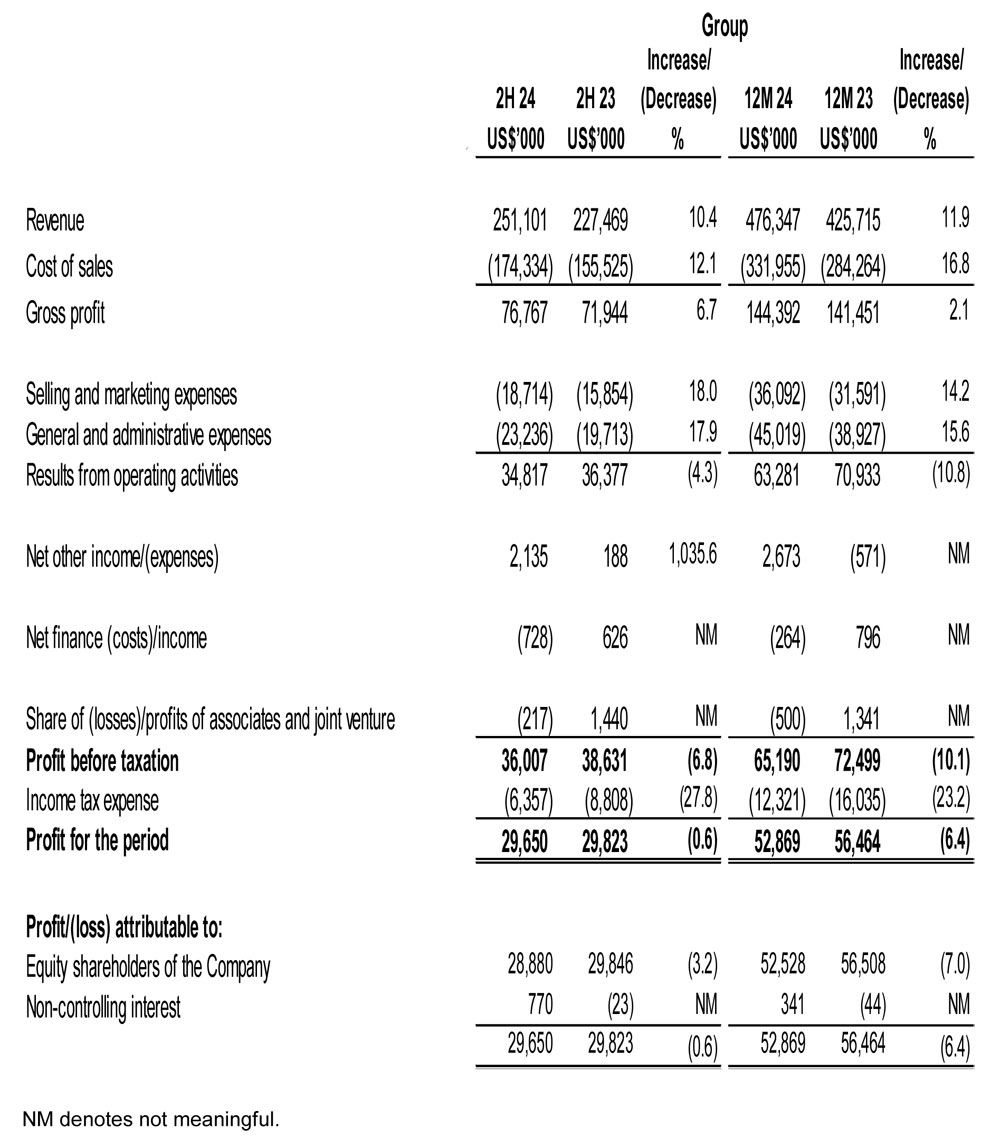

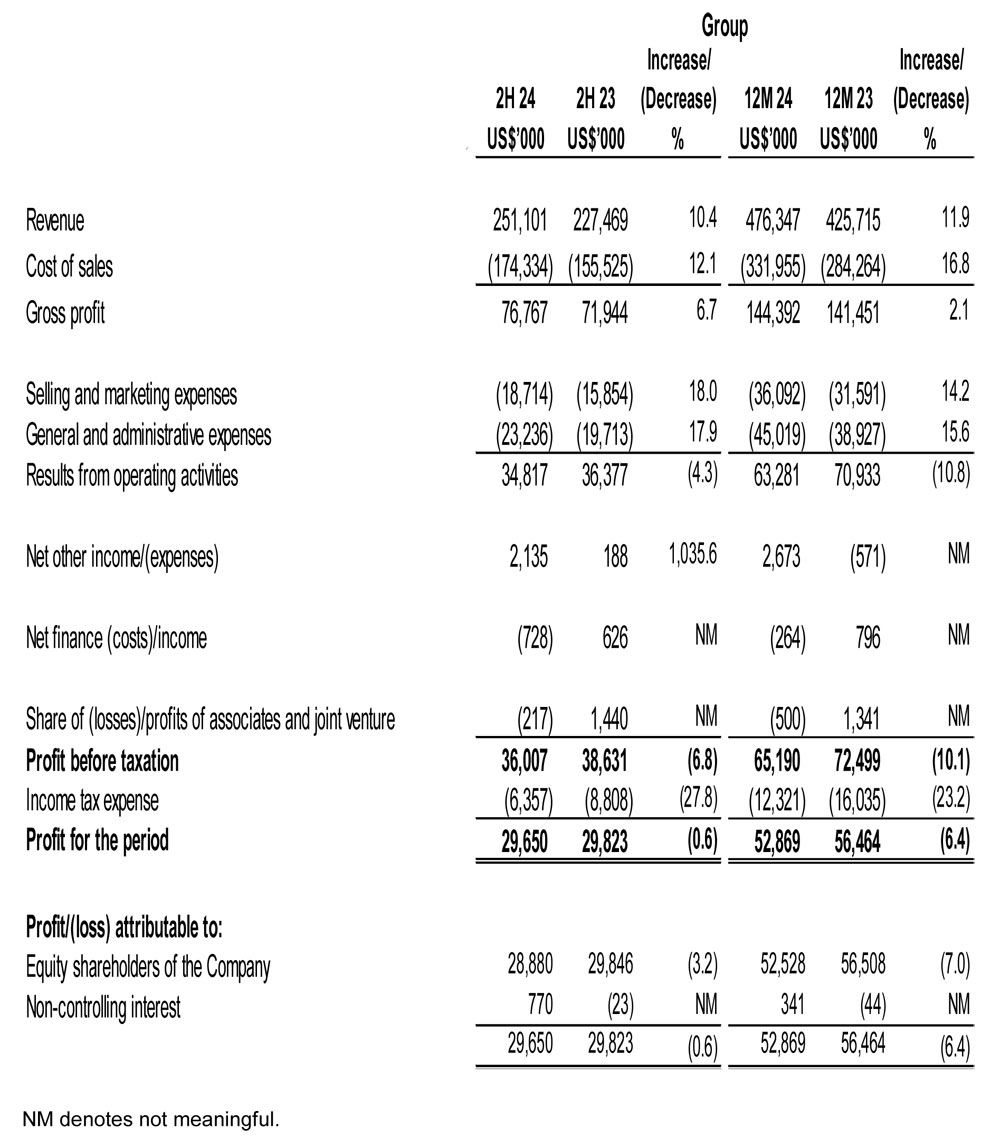

Consolidated income statement

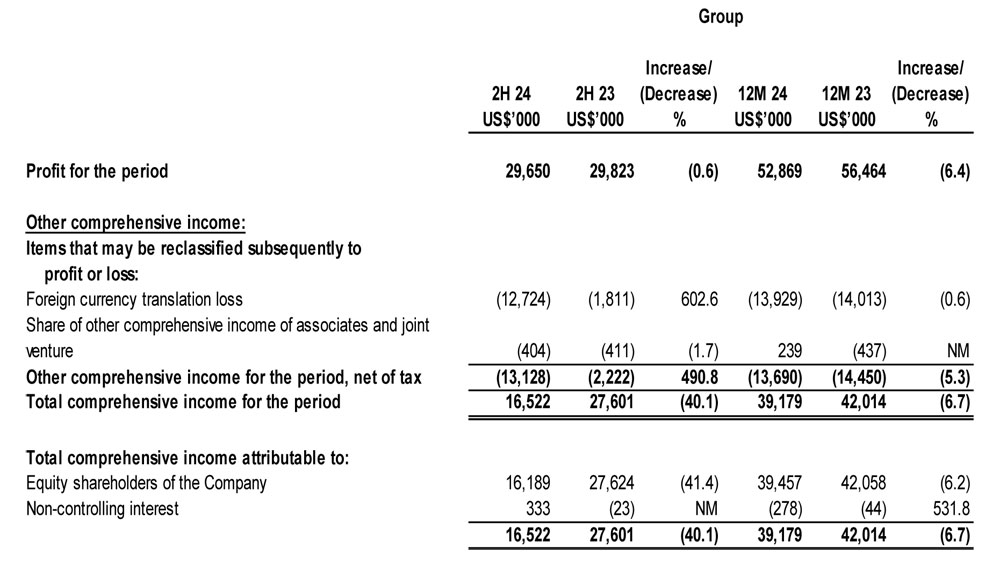

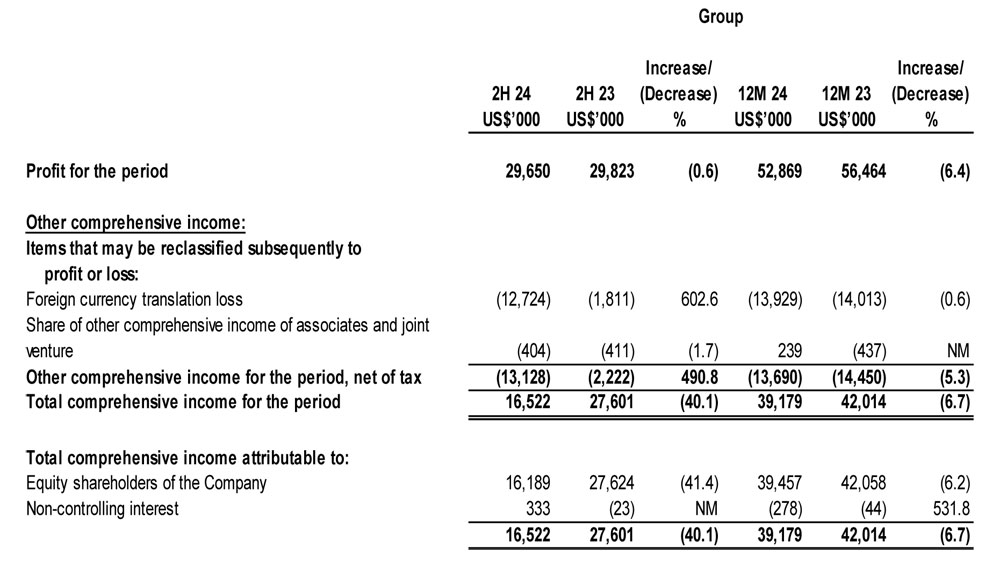

Consolidated statement of comprehensive income

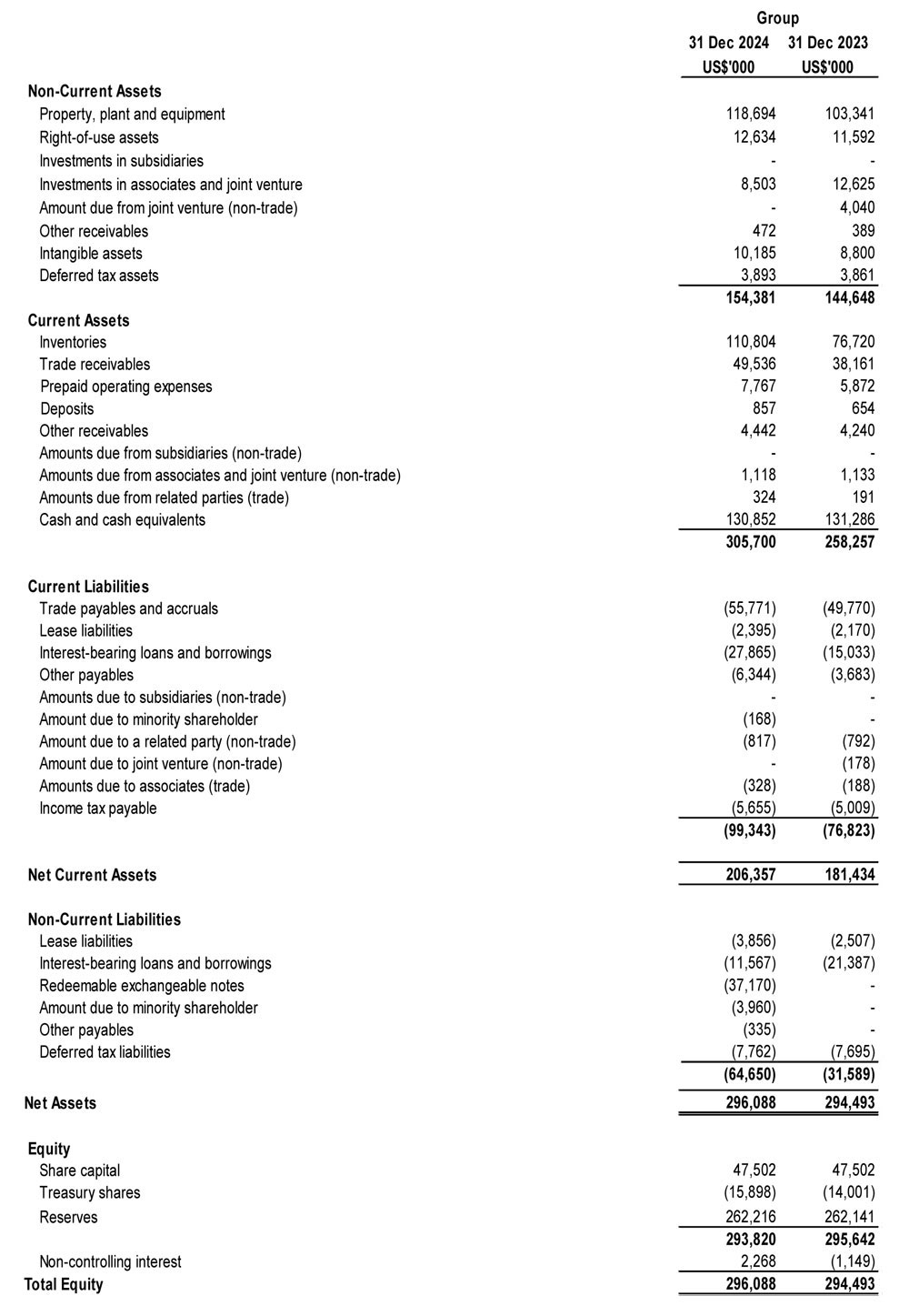

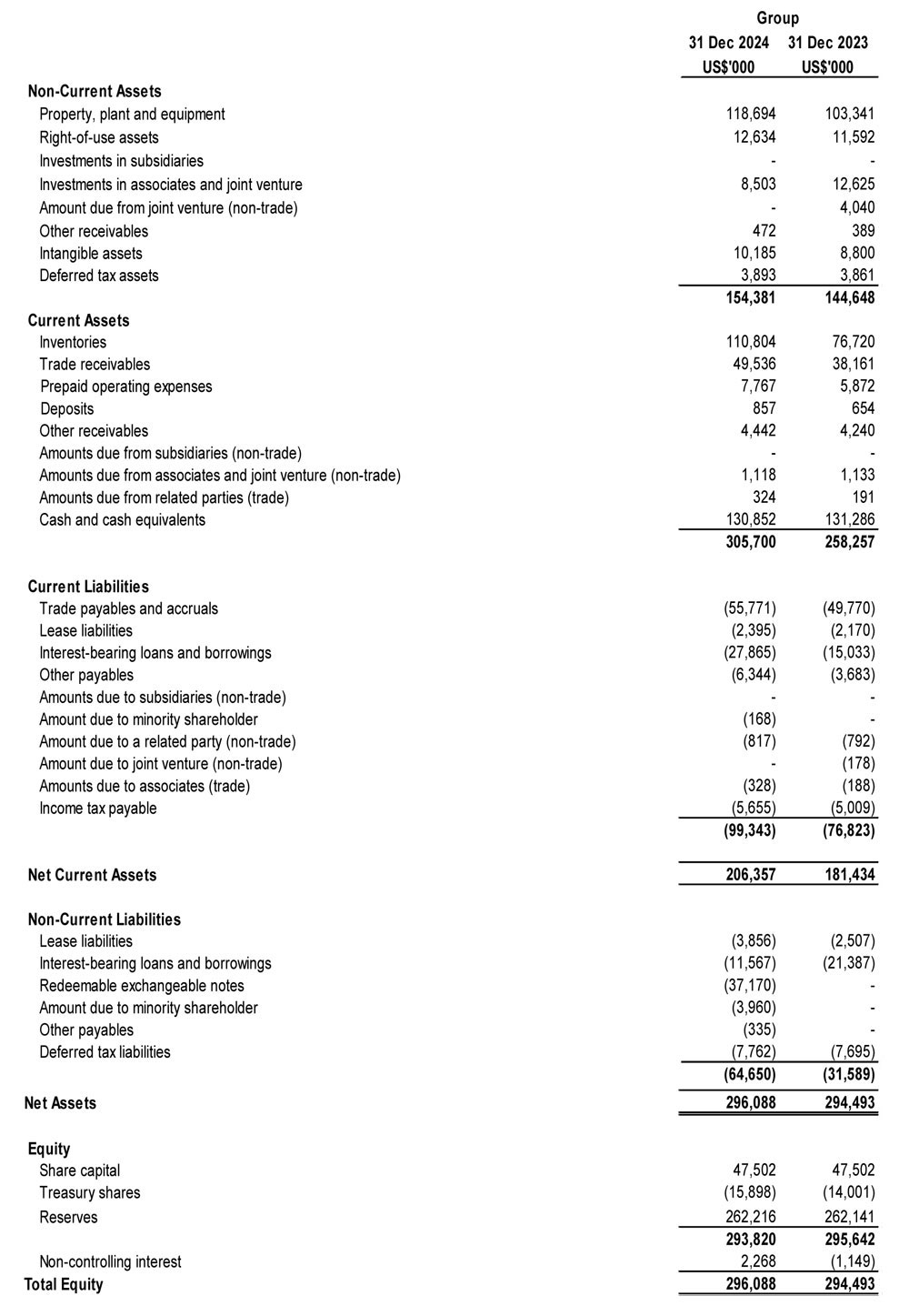

Balance sheets

Review of Performance

Revenue for the financial year ended 31 December 2024 ("FY2024") was US$476.3 million, a 11.9% increase compared with US$425.7 million in FY2023. The Group’s net profit after tax was US$52.9 million in FY2024 as compared to US$56.5 million in FY2023.

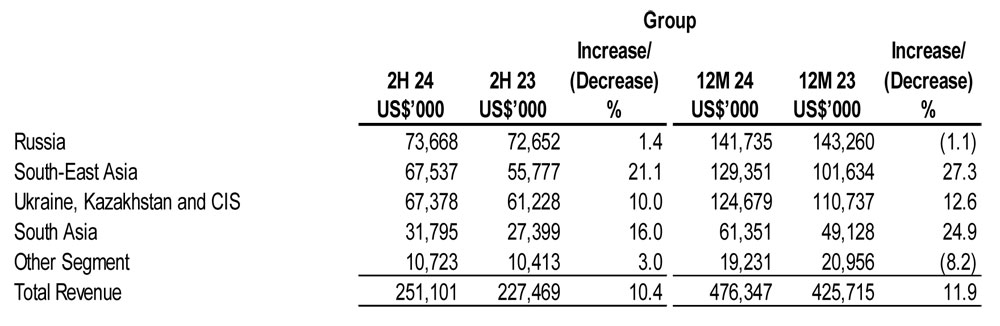

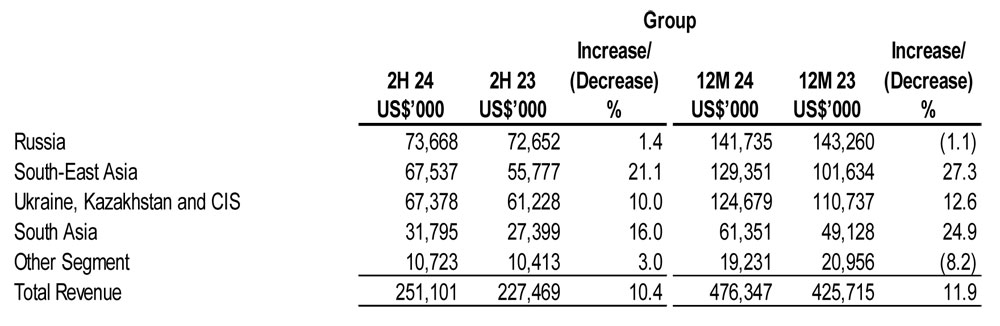

Revenue by Segments

In the Group’s Russia segment, revenue in FY2024 recorded a small decline of 1.1% to US$141.7 million from US$143.3 million in FY2023 mainly due to the depreciation of the Russian Ruble against the US dollar. The revenue recorded in local currency terms increased by 7.3% mainly due to effective price positioning to reflect higher cost of ingredients.

Revenue from the Group’s South-East Asia segment increased by 27.3% to US$129.4 million in FY2024 from US$101.6 million in FY2023 mainly due to a significant increase from its Vietnam market driven by intense consumer marketing and promotional activities. In addition, the Group also recorded higher sales volumes from its non-dairy creamer plant in Malaysia.

The Group’s Ukraine, Kazakhstan and CIS segment revenue achieved 12.6% increase to US$124.7 million from US$110.7 million in FY2023. The improvement was driven mainly by higher sales across the segments, particularly from the Group’s CIS market in view of higher sales volume and higher pricing coupled with new contribution from Tea House LLP, which became a subsidiary in May 2024. Tea House LLP is one of the leading producers of tea in Kazakhstan.

In the Group’s South Asia segment, revenue increased by 24.9% to US$61.4 million in FY2024 from US$49.1 million in FY2023. This was mainly due to increased sales contribution from instant coffee products as well as price adjustments made to reflect the higher cost of coffee beans.

On a half-yearly basis, the Group’s revenue in 2H2024 was US$251.1 million, which was 10.4% higher than US$227.5 million in 2H2023 mainly from the Group’s South-East Asia segment particularly from Vietnam market.

Profitability

For FY2024, excluding the fair value gain of US$2.8 million from the redeemable exchangeable notes1, the Group’s normalised net profit after tax decreased from US$56.5 million in FY2023 to US$50.0 million in FY2024. For 2H2024, excluding the fair value gain of US$2.8 million from the redeemable exchangeable notes1, the Group’s normalised net profit after tax decreased by 10.1% to US$26.8 million mainly due to lower profit contribution from the Group’s Russia market arising from short term price disruption in the market. This decrease was partly offset by higher contribution from the Group’s South Asia segment in spite of higher ingredient prices and higher operating expenses.

For FY2024, sales and marketing expenses increased 14.2% from US$31.6 million in FY2023 to US$36.1 million in FY2024. For 2H2024, sales and marketing expenses increased from US$15.9 million to US$18.7 million. The increase was mainly due to higher consumer engagement activities, particulary from the Group’s Vietnam market.

For FY2024, general and administrative expenses increased 15.6% from US$38.9 million in FY2023 to US$45.0 million. For 2H2024, general and administrative expenses increased 17.9% to US$23.2 million. The increase was mainly due to higher legal and professional expenses in relation to the issuance of the redeemable exchangeable notes.

Balance Sheet & Cashflow

As at 31 December 2024, the Group’s inventories increased by US$34.1 million to US$110.8 million. The increase in inventory level was to ensure operational continuity due to global supply chain disruptions and geopolitical disturbances.

As at 31 December 2024, the Group’s property, plant and equipment increased by US$15.4 million to US$118.7 million mainly from the Group’s non-dairy creamer plant in Malaysia and the first coffeemix production facility in Kazakhstan.

The Group’s trade receivables increased by US$11.3 million from US$38.2 million as at 31 December 2023 to US$49.5 million as at 31 December 2024 mainly due to higher sales.

The Group generated a cash inflow of US$25.5 million from operating activities in FY2024 bringing its cash and cash equivalents to US$130.9 million as at 31 December 2024.

The Group’s net assets as at 31 December 2024 was US$296.1 million. The net asset value per ordinary share (excluding non-controlling interests) as at 31 December 2024 was 55.84 US cents as compared to 56.20 US cents as at 31 December 2023.

Commentary

Food Empire expects demand for its products to remain stable across all its segments as it continues to invest in product R&D, new product launches, brand building efforts as well as advertising and promotional activities to drive sales across all markets.

The Group expects future growth to come mainly from Asia and will focus its investments on developing its business in this region.

To sustain the strong growth in Vietnam, the Group will continue to invest in strengthening its brand presence, gain consumer loyalty and drive higher sales. In Malaysia, the Group completed the expansion of its non-dairy creamer manufacturing facility in 2Q2024 with newly added capacity that is expected to ramp up to full utilisation over the next two to three years. In addition, the expansion of the snack manufacturing facility is expected to be completed by the first quarter of 2025 with commercial production to commence by the second quarter of the year.

As part of its regional expansion strategy, the Group has invested in new production facilities in Asia including a new coffee-mix production facility in Kazakhstan, which will be completed by the end of 2025. Its new freeze-dried soluble coffee manufacturing facility in Vietnam is expected to be completed by 2028.

The Group is mindful of macro factors that may impact its business. These include geopolitical tensions as well as climate change, which has driven up the cost of raw materials such as coffee beans. It will remain vigilant of any potential impact that geopolitical events may have on its business and will continue to conduct periodic reviews and manage its business strategies to mitigate these challenges.

1 In FY2024, the Group’s wholly owned subsidiary, Empire APAC Pte. Ltd. issued 5.5% redeemable exchangeable notes to Merit Genesis Pte Ltd and Apex Genesis Pte Ltd at an aggregate value of US$40,000,000 that are convertible into new ordinary shares in the capital of the Company.